How can Banks benefit from Alquant?

Investment Committee Support

Take efficient decisions based on data-driven actionable indicators during investment committees to know which asset class should be under- or over-weighted.

Ready-Made Investment Products

Easily invest in highly regulated investment products focused on downside protection and developed by Alquant after years of data-driven research.

Outsourced Quantitative Team

Make Alquant your quantitative team to develop tailored solutions you've always wanted and turn them into real investment products.

Enhance the performance of multi-asset mandates while maintaining the same risk profile

Your situation

You are a bank looking for a solution to support tactical investment decisions within your organization. In this context, you need interactive and data-driven tools to better distinguish low-risk from high-risk regimes. You know that disciplined tactical decisions can help improve performance during bull markets while avoiding unnecessary risks in turbulent times.

>> Our solution

Enhance the performance of multi-asset mandates while maintaining the same risk profile

Your situation

You are a bank looking for a solution to support tactical investment decisions within your organization. In this context, you need interactive and data-driven tools to better distinguish low-risk from high-risk regimes. You know that disciplined tactical decisions can help improve performance during bull markets while avoiding unnecessary risks in turbulent times.

Our solution

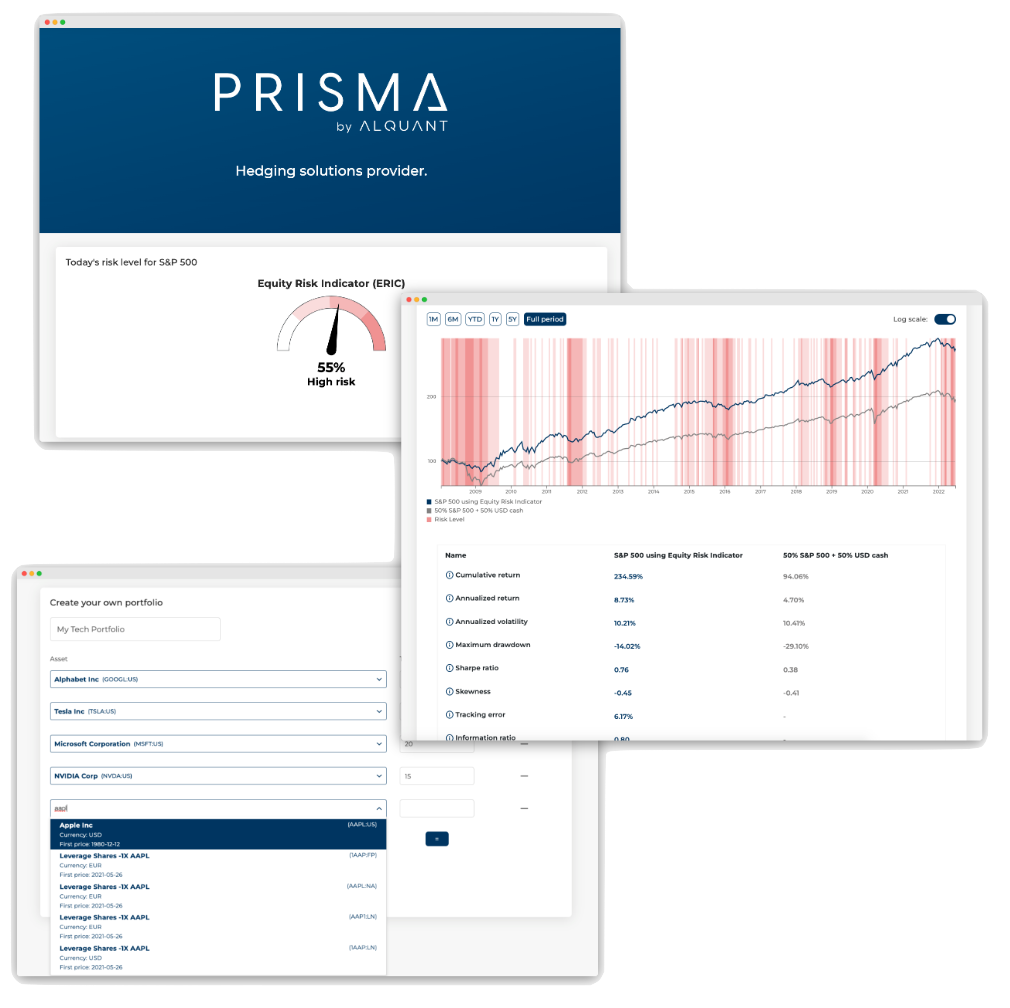

Alquant's Prisma provides a disciplined approach to tactical investing that helps generate higher returns while strictly controlling risk. With Prisma, you maintain control over discretionary mandates while benefiting from the clear insights of Alquant's risk indicators.

Let your portfolio managers leverage our customizable risk indicators to make impactful tactical decisions. The combination of talented portfolio managers and powerful data-driven algorithms is an effective way to generate alpha. Also, Prisma brings a fresh perspective to your investment committee to respond appropriately to market conditions and proactively manage risk during turbulent times.

Alvola: The proactive tail-hedging solution

Your situation

The cost of continuous portfolio hedging via put options or existing tail hedge solutions is exorbitant. Thus, because you can't efficiently hedge your clients' portfolios against drawdowns, you maintain cash on hand when appealing buying opportunities appear after market downturns and corrections.

>> Our solution

Alvola: The proactive tail-hedging solution

Your situation

The cost of continuous portfolio hedging via put options or existing tail hedge solutions is exorbitant. Thus, because you can't efficiently hedge your clients' portfolios against drawdowns, you maintain cash on hand when appealing buying opportunities appear after market downturns and corrections.

Our solution

As an innovative tail-hedging product, Alvola aims to generate robust performance during periods of extreme market turmoil. Alvola also helps to make sure portfolios succeed in all market phases by targeting positive absolute returns over an entire market cycle and negatively correlated returns to the equity market.

To avoid the negative carry common to many hedging solutions Alvola dynamically targets long volatility exposure through derivatives during market turmoil while remaining mainly exposed to cash during bull markets. Alvola is a perfect equity diversifier and an attractive alternative to cash equivalents. By replacing a portion of your cash reserves with Alvola, you can significantly increase your downside protection and increase your purchasing power after a crash without adding derivatives that need to be rolled over and thereby avoiding complexity.

Convexus: Defensive equity 2.0

Your situation

You like defensive stocks because of their low realized volatility. However, they tend to underperform during bull markets and, in the event of a sharp decline, they often offer no real protection. To effectively protect your equity exposure, you would have to buy put options, but this is very expensive and would also negatively impact your long-term performance.

>> Our solution

Convexus: Defensive equity 2.0

Your situation

You like defensive stocks because of their low realized volatility. However, they tend to underperform during bull markets and, in the event of a sharp decline, they often offer no real protection. To effectively protect your equity exposure, you would have to buy put options, but this is very expensive and would also negatively impact your long-term performance.

Our solution

Alquant's equity UCITS fund called Convexus is an attractive alternative to defensive or put-protected equity solutions. Indeed, Convexus achieves lower realized volatility than blended equities while tending to provide better protection in major market downturns than standard low volatility solutions. Compared to put-protected solutions, Convexus seeks to better capture equity upside by minimizing hedging costs during strong market rallies without compromising on strong protection against sharp equity declines.

At its core, Convexus provides passive U.S. equity exposure enhanced by a dynamic derivative risk overlay based on Alquant's risk indicators. Through this dynamic risk overlay, Convexus aims to significantly reduce the impact of sharp equity declines while providing returns similar to the broad U.S. equity market during bull markets.

Quant as a service - Collaborate with Alquant, your Quantitative Lab

Your situation

As a bank, you are interested in quantitative finance, specifically in incorporating data-driven and systematic investment strategies into your clients' portfolio. However, your lack of an in-house quantitative team means you don't have the research capacity to develop these strategies yourself and would like to start your project immediately without the costly recruitment process.

>> Our solution

Quant as a service - Collaborate with Alquant, your Quantitative Lab

Your situation

As a bank, you are interested in quantitative finance, specifically in incorporating data-driven and systematic investment strategies into your clients' portfolio. However, your lack of an in-house quantitative team means you don't have the research capacity to develop these strategies yourself and would like to start your project immediately without the costly recruitment process.

Our solution

Alquant's extensive quantitative research experience and infrastructure means we can develop robust systematic investment strategies that fit your needs. Our dedicated team works to understand your investment goals and deliver high-quality ready-to-use solutions.

Given your inputs, we carry out quantitative research and develop algorithms and data-driven investment strategies. This can range from building your tailored tail-hedging solutions, tactical asset allocation, or even actively managed equity and crypto strategies.

Our automated and interactive platform saves you time and makes the research results transparent and interactive. With Alquant’s FINMA license we can create and manage a certificate or fund following your research idea, so it can be easily included into all your client portfolios.