Quantitative Research

Take smarter tactical investment decisions with Prisma

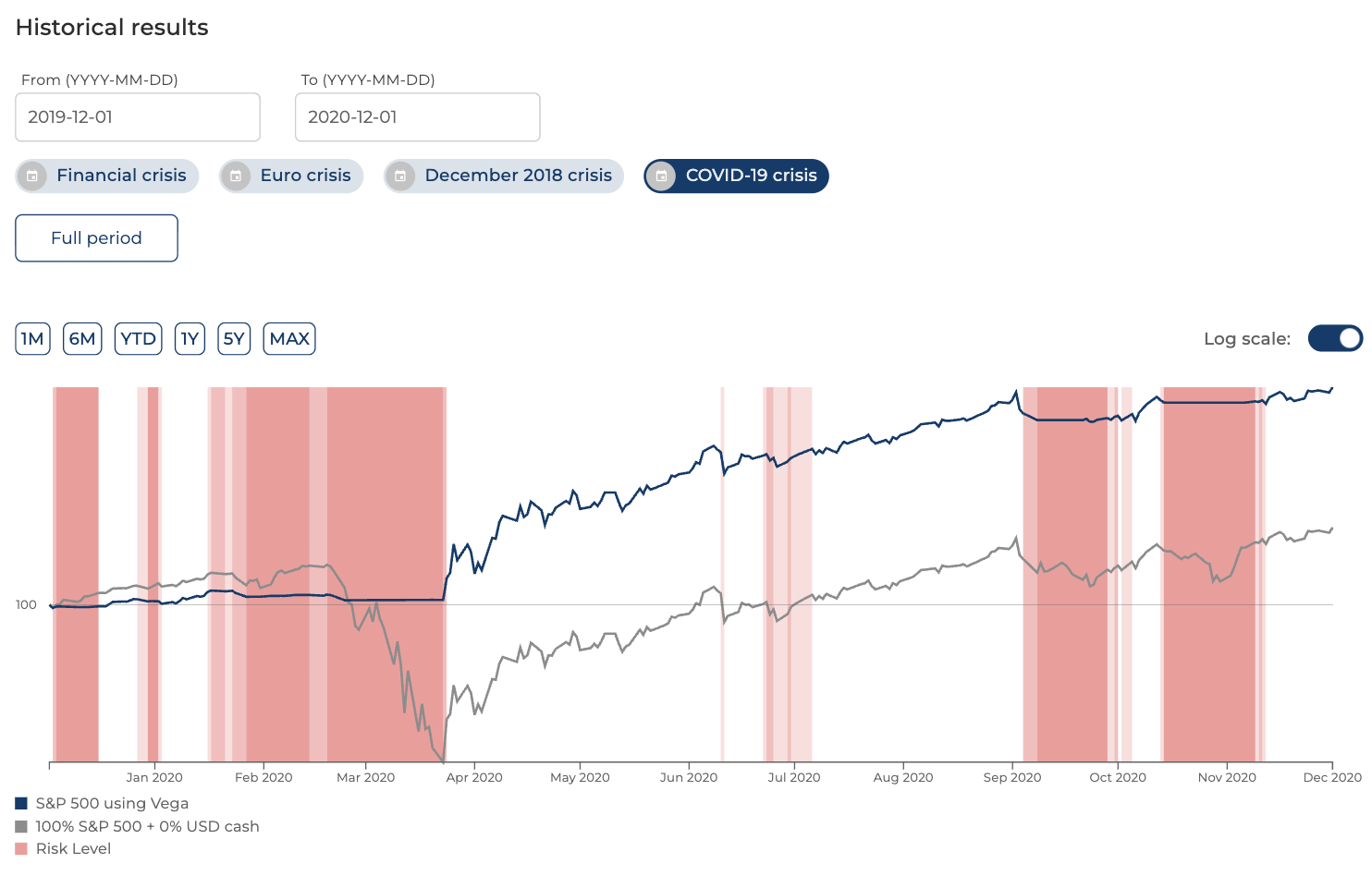

Don’t stay locked into a static 60/40. Prisma helps you overweight in calm markets and protect in turbulent times.

We don’t try to predict the market, we measure risk and manage exposure with evidence.

.jpg)

See in action

The Challenge

Markets change, your allocation should too

A fixed allocation like 60/40 is simple, but it’s blind to risk. In downturns, you stay fully exposed. In bull phases, you may hold back too much. Prisma gives you the signals to adapt. Overweight or underweight equities with confidence, adding flexibility without losing discipline.

Discover PrismaProven Use Cases & Results

Three Ways to Elevate Your Strategy

Prisma’s risk signals are designed to adapt your portfolio to changing market conditions. They help you protect capital when volatility rises and seize opportunities when markets calm, always within your own investment framework.

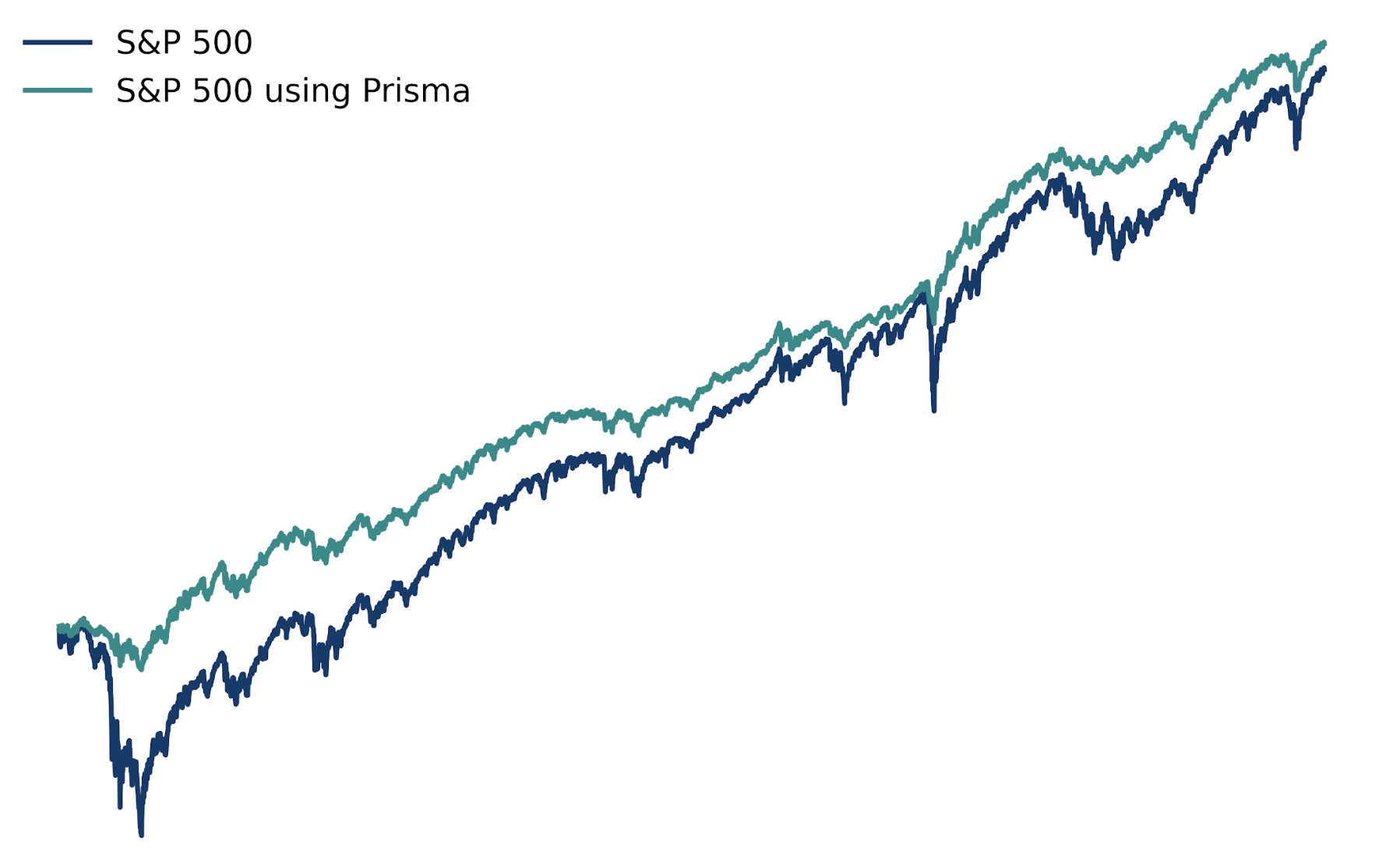

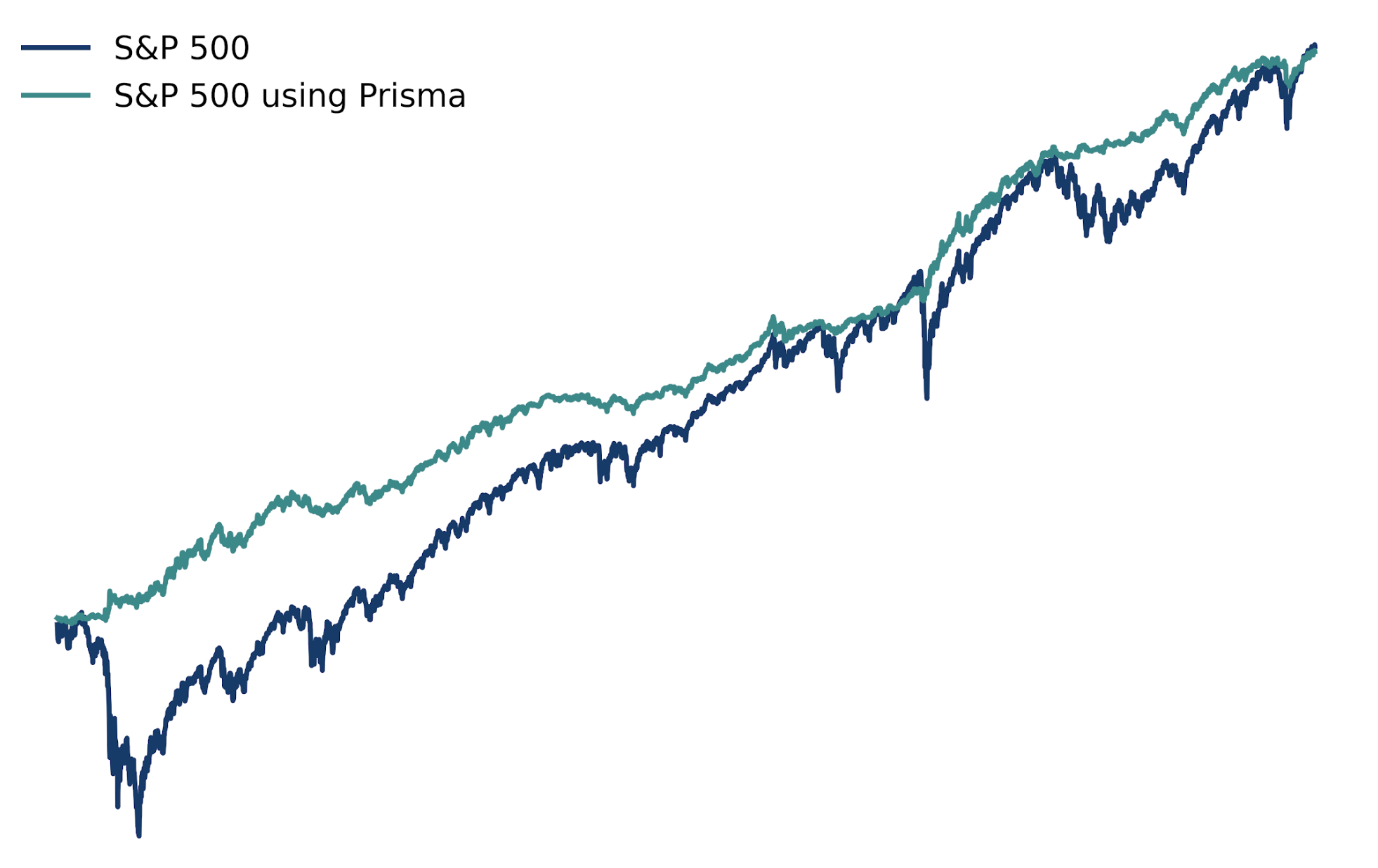

Reduce Drawdowns, Control Volatility

Use Prisma to dynamically hedge equity exposure and manage risk more effectively, so you can stay invested with greater stability.

Enhance Long-Term Returns

Leverage signals to increase equity allocations during favorable conditions and reduce exposure when risks rise, aiming for stronger long-term performance without amplifying overall risk.

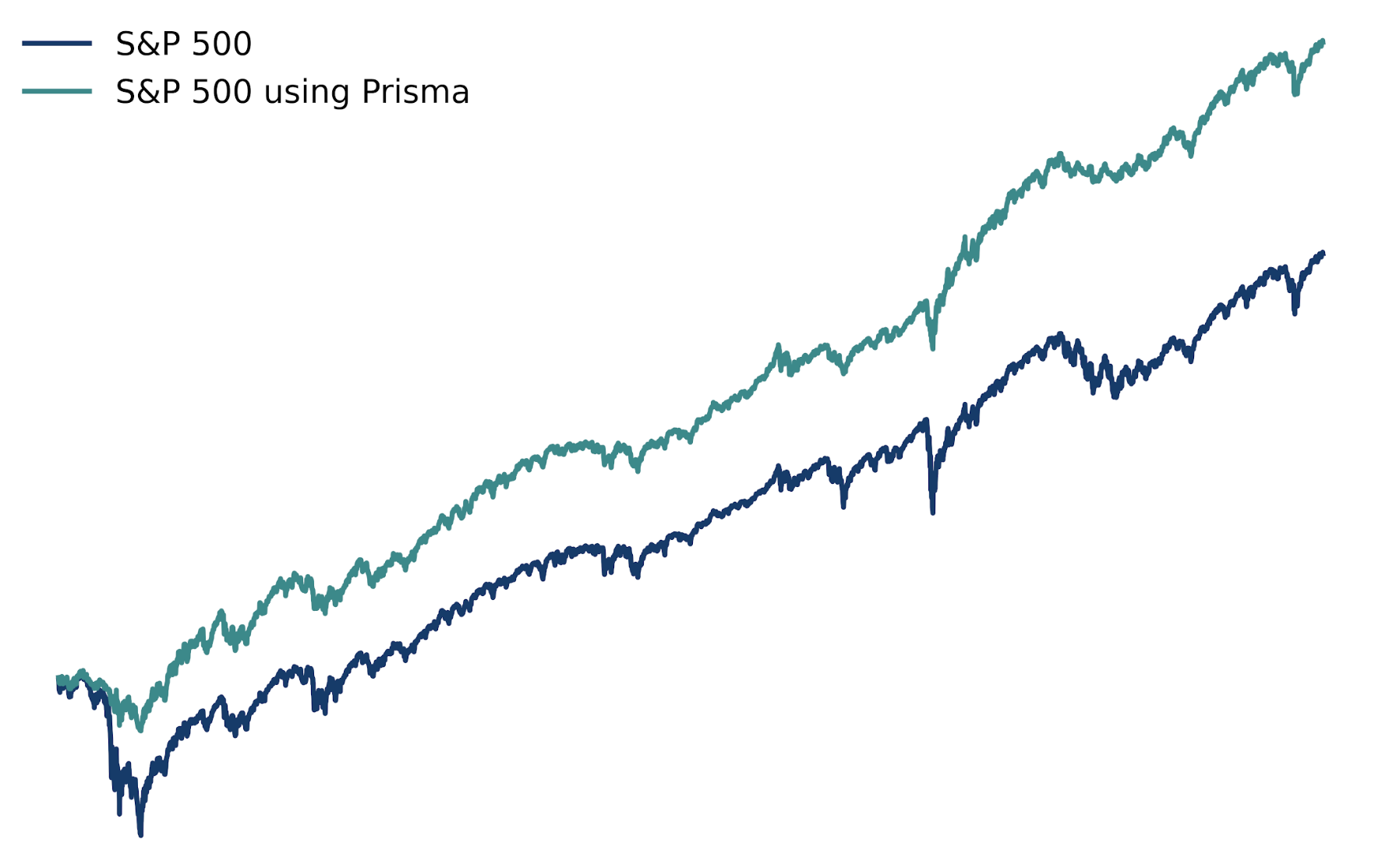

Capture Opportunities in All Markets

Profit from both bullish and bearish phases by using Prisma as an absolute return overlay, turning risk signals into performance drivers across market cycles.

The Prisma Advantage

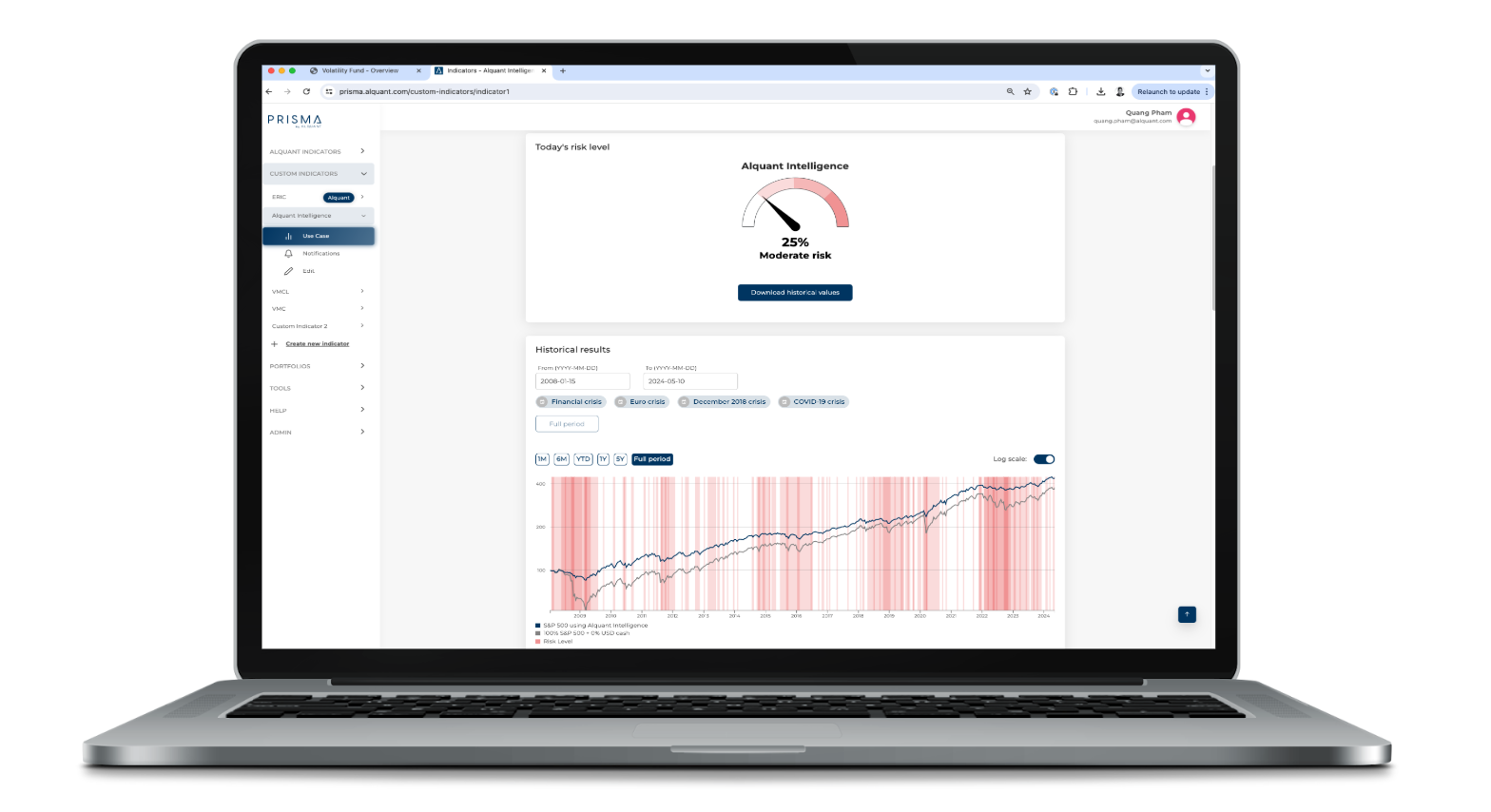

Data-driven risk indicators at your fingertips

Prisma puts a unique universe of signals into the hands of asset managers and investment committees, rigorously tested, intuitive to use, and ready to guide real allocation decisions.

Actionable Signals

Adjust equity exposure dynamically with daily or custom rebalancing.

Comprehensive Market View

Combine systematic insights with your committee’s in-house perspective.

Proven Research Backbone

Built on data science, machine learning, and financial expertise.

Swiss Academic Innovation

Developed from EPFL and ETH Zurich research, Prisma carries Swiss precision into modern portfolio management.

The Prisma Indicator Universe

A broad suite of risk indicators with proven core signals

Prisma offers a wide and growing universe of signals covering equity volatility, macroeconomics, momentum, credit spreads, and more. Among them, three core signals have been live since 2018 and remain at the heart of many allocations:

Vega Indicator – Detects panic in equity markets via VIX dynamics.

Macroeconomic Indicator – Tracks real-time global economic trends.

Credit Indicator – Monitors global high-yield spreads to capture systemic risk.

These can be combined, weighted, and customized with additional signals to match your investment process.

Explore Indicators

Blog

.svg)